The Chinese telecommunications company Huawei recently has made significant inroads into European markets using a strategy of innovation partnerships with customers and governments.

Image credit : Shyam's Imagination Library

Emerging markets such as China and India have become the growth drivers of corporate R&D initiatives from all around the world. Although there is growing evidence that Chinese companies are shifting their innovation focus from cost savings to knowledge-based research, the view by many in the West remains that companies based in emerging markets are not ready to take over the role of leading innovators from their Western competitors. As a result, Chinese multinationals have been at a competitive disadvantage, particularly in strategic technology industries.

What can Chinese multinationals do to overcome Western barriers to entry in strategically important technology industries in which “Made in China” or “Designed in China” are viewed as negatives? What dynamic innovation capabilities — or, put another way, what culturally specific processes — should companies focus on to gain acceptance in the competitive global marketplace?

To answer these questions, I studied Huawei Technologies Co. Ltd., the Chinese telecommunications company that has recently made significant inroads in Europe’s mature and strategically important telecommunications industry. (See “About the Research.”) Huawei, which is based in Shenzhen, is one of the first Chinese multinationals to be competitive in the West in a strategic technology industry, making it a potential role model for companies in China and other parts of Asia that hope to transition from being a follower to being a market leader.

To achieve its position, Huawei has aggressively pursued a strategy of joint innovation with leading European customers and governments. In this article, I will discuss how Huawei worked closely with European customers to develop joint innovation capabilities. In the process, the company was able to emerge as a leader in telecommunications in Europe.

About the Research

This article is based on a five-year study of how Chinese technology companies have upgraded their capabilities in the European Union.i Not only had Huawei become a leading telecommunications equipment provider and a leader in terms of its number of patent applications, competitors were recognizing its innovation collaborations with European telecom operators as best practice. To understand the origins of Huawei’s success, I studied the company’s development from 1987 through its emergence as an influential competitor in the European Union. With the help of two research assistants, I conducted 56 semistructured interviews with Huawei managers, competitors, policymakers, lobbyists, and customers in China, the European Union, North America, and Latin America, and reviewed materials such as company histories, annual reports, internal documents, and other reports. We explored how Huawei managers were able to convince customers in China and Western Europe to choose their services and products over those of established competitors and how it developed its innovation capability.Huawei’s Joint Innovation Capabilities

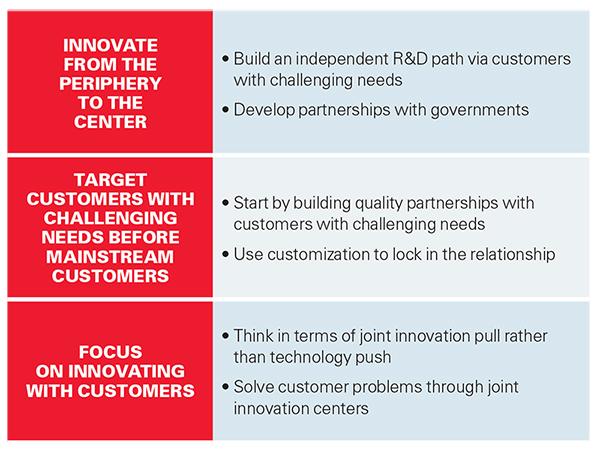

Indian companies such as Bharti Airtel Ltd., a telecommunications services company headquartered in New Delhi, have demonstrated the importance of adaptive partnerships with suppliers and customers in emerging markets. What sets Huawei apart are its joint innovation capabilities and the conditions that prompted and are still fueling their development. (See “The Building Blocks of Huawei’s Joint Innovation Strategy.”)The Building Blocks of Huawei’s Joint Innovation Strategy

Huawei has relied on a combination of practices as the basis of its joint innovation strategy. These building blocks have been effective in both emerging and developed markets.

| Innovate from the periphery to the center | • Build an independent R&D path via customers with challenging needs |

|---|---|

| • Develop partnerships with governments | |

| Target customers with challenging needs before mainstream customers | • Start by building quality partnerships with customers with challenging needs |

| • Use customization to lock in the relationship | |

| Focus on innovating with customers | • Think in terms of joint innovation pull rather than technology push |

| • Solve customer problems through joint innovation centers |

Although a common Western view is that China’s culture of innovation is constrained by cultural and political forces, the reality is that China has a strong entrepreneurial side. Many Chinese entrepreneurs have aspirations and innovation leadership goals that are aligned with their North American and European counterparts. Less than a decade after the company was founded in 1987,

Huawei announced that it wanted to become one of the world’s leading players in telecommunications. From the beginning, it has recruited talented engineering graduates from top Chinese universities with competitive salaries and employee bonuses, and it has made a point of investing 10% or more of its sales in R&D projects as a way to compete with Western competitors.

Huawei has effectively turned some of the core values from China’s Cultural Revolution, such as self-criticism and constant struggle, in the direction of competition8 while also tapping into more modern Chinese social values to advance innovation. For example, success and ambition are highly valued in China, yet Chinese employees tend to be less focused on receiving personal credit than their Western counterparts and more willing to admit to failure. Huawei, which had 2015 revenue of $60.1 billion, has reinforced its values with employee ownership and a bonus-driven management structure.

In the early days, Huawei’s strategy in China was to target rural townships far from the centers of power and multinational attention. Local operators, hotels, and factories needed customized networking gear and central office switches that could operate under local conditions such as poor transmission quality (and even rats chewing electrical wires). Because Huawei was not able to obtain capital from banks or government at that time, its earliest R&D efforts focused on working with its local customers on customized, cost-effective solutions. By taking the time and making the necessary investments to address their requirements, Huawei was able to overcome barriers to entry that typically stood in the way of private companies in China. Local bureaucrats operating far from the centers of capital and power began to see Huawei as an important vehicle for public-private cooperation.

Through its work with local operators in China, Huawei learned how to collaborate successfully with partners (including governments) to provide customized telecommunications equipment. Eventually, it was able to leverage this capability to gain a foothold with China’s largest telecom customers in the major cities. Huawei’s CEO and founder, Ren Zhengfei, who came from a rural town and was an engineer and scientist in the People’s Liberation Army, has attributed the company’s approach to innovation to two very different main influences: the principles of the Chinese Cultural Revolution and the customer-centric views of former IBM Corp. CEO Louis Gerstner.1

A Three-Stage Strategy for Europe

In order to make inroads in Europe, Huawei has typically relied on the same strategy it used to build its market position in China: (1) offer customized technologies that meet the practical needs and resource constraints of target customers; (2) build customer loyalty by enhancing practical innovation with longer-term joint innovation partnerships; and (3) enlist the support of governments, universities, and other industry stakeholders by customizing further innovation investments to their priorities, so as to be viewed as a “model citizen.” (See “Huawei’s Three-Stage Approach.”)

While the first two stages are sequential, the timing for the third stage varies depending on the

particular innovation context and the barriers to entry in the specific market. Some markets, such as the United States, have been especially difficult to penetrate, as will be discussed. Regardless of the exact chronology, the three stages often overlap, as Huawei’s innovation experience in both China and Europe demonstrates.Stage 1: Offer customized technologies that meet the practical needs and resource constraints of target customers.

Anticipating significant customer and government barriers to entry in Western European markets, Huawei starting sending employees there beginning in 2001. Even with direct support from top management, Huawei had a difficult time persuading European operators that a Chinese company was capable of producing anything but simple products — especially the state-of-the-art, high-tech equipment they sought. The first breakthrough occurred in 2004 with Telfort B.V., a mobile telecommunications provider based in Amsterdam. At the time, Telfort billed itself as a no-frills challenger to the established norms of the mobile industry. Lacking the financial strength of bigger operators such as London-based Vodafone or Paris-based France Télécom (now Orange), and looking for a way to go up against established equipment suppliers such as Ericsson and Alcatel-Lucent, Telfort was willing to make a bet on Huawei’s products.13 Huawei demonstrated a refreshing willingness to listen closely to Telfort’s requests and find smart solutions to its unmet needs. By working closely with Telfort, Huawei was able to produce a distributed base station that cost less and required less energy to operate than traditional ones.

Winning over customers such as Telfort was no easy feat. To do so, Huawei had to present a low-risk alternative to what the established vendors provided. It achieved this by offering free testing and technical support. The hardware itself was often priced significantly below that of established competitors.14 What’s more, instead of limiting service to typical Monday through Friday business hours, Huawei promised service availability 24/7, with equipment transportation, installation, and maintenance at no extra charge.

Huawei’s innovation model has been closely tied to its heavy investment in R&D. The company has typically invested more than 10% of its revenues in R&D during the past 15 years, outspending its European competitors in absolute terms. Given the relatively low cost of Chinese engineering talent, Huawei is able to assign more engineers to projects than its competitors can. For instance, even when the company had its first conversations with prospective customers in Western Europe in 2000, it employed 10,000 university-trained engineers. Today, it employs more than 50,000 developers and engineers, more than any of its Western competitors. In its attempts to be seen as best of class, Huawei made huge investments in technology testing, and it has encouraged employees to get involved with the major standardization bodies. Through these actions, Huawei has communicated the emphasis it places on quality while still offering custom solutions that are configured to meet the needs of individual customers.

Build customer loyalty by enhancing practical innovation with longer-term joint innovation partnerships.

On its own, Huawei’s customer-centered perspective was only able to take the company so far. Indeed, the company had to work hard to counter the perception that its products were not up to the quality of those made by competitors. Huawei began to downplay that it was the least expensive provider; while offering highly competitive prices, it emphasizes its ability to mobilize its large numbers of technical people to design and implement smart solutions quickly.

Huawei’s innovation strategy began to pay off in significant ways after it signed a deal in 2005 with Vodafone, one of the largest mobile telecommunications companies in the world. Eager to gain an edge against Telefónica in Spain, Telefónica’s home market, Vodafone looked for an equipment supplier that could help it build a large number of third-generation wireless network base stations using the UMTS (Universal Mobile Telecommunications System) standard. It selected Huawei over leading competitors to provide the radio-access part of the network. What distinguished Huawei’s winning bid from those of others was only partly price; it was also the speed of execution. Huawei helped Vodafone build and install 10,000 base stations within one year, two to three times faster than competitors.

In 2011, Telenor Group, a large Norwegian mobile telecommunications company that operates in Scandinavia, Eastern Europe, and Asia, became another Huawei customer. Telenor wanted to build a high-speed wireless base station in one of the most remote and frigid parts of Norway. Other equipment providers shunned the project due to the extreme working conditions, the tight schedule, and high overhead costs, leaving Huawei as the sole bidder. Huawei used the project to showcase the practicality of its latest network solution, which supported multiple mobile communications standards and wireless telephone services on one network. At the same time, the company demonstrated the flexibility and customer-centricity of its engineers and its ability to perform under adverse conditions. Using a wide range of transportation modes (including helicopters and snowmobiles), Huawei engineers completed the 4G wireless base-station project faster than expected.

Huawei was able to formalize its relationships with leading European operators such as Vodafone and Telenor by establishing what it calls joint innovation centers, which provide a collaborative environment for managing the customer-supplier relationship and remove some of the long-term uncertainties. Joint innovation centers provide a platform for Huawei and its customers to work through complex issues together.

Rather than undertaking several projects at once, joint innovation centers focus on one problem at a time. Representatives of the telecom operator and Huawei come together to explore problems and potential solutions. Input from senior management on both sides is an important part of the process. Such high-level involvement helps build trust, which is reinforced by clear rules for protecting intellectual property and sharing risk.

To appreciate how joint innovation centers work and how they can enhance strategic partnerships with operators, consider the way Huawei collaborated with Vodafone in 2006 and 2007 to develop a radio-access technology to enable mobile telecommunications operators to support multiple mobile communications standards and wireless telephone services on one network. To manage this project, Vodafone’s global network director and a director of Huawei’s enterprise management team brought their teams to Madrid twice a year, where they reviewed progress and determined what to do next.

The Vodafone and Huawei engineers had identified a looming strategic problem: Vodafone needed to retire 110,000 2G sites over the next three years and replace them with equipment to support the next generation of mobile technology. Realizing how disruptive the transition might be for Vodafone and its customers, the team proposed investigating a less complicated (and less expensive) way to achieve the network upgrade, using software rather than hardware; the steering committee agreed to invest substantial resources.

The project involved significant risks for both companies. Although there was the possibility that Huawei could neutralize the technological threat that loomed over 2G network owners, doing so would require significant investment at a time when its role in the European network infrastructure was extremely limited. For Vodafone, there was a question of whether casting its lot with Huawei, a relative upstart, was a prudent move. As the industry wrestled over the future industry standard, no doubt there were safer moves. At this juncture, the two companies recognized that they needed to move beyond the traditional supplier-buyer model to embrace joint innovation.

This also involved sorting out the intellectual property rights issues that may ensue from the codevelopment of a distributed base station. As part of their agreement to work together, Huawei and Vodafone agreed to protect each other’s intellectual property in the domain they were working in. After two years of development and several meetings, Huawei delivered the first updated network in 2008. The solution increased wireless coverage by 25%, reduced the number of required base-station sites by 40%, and reduced the total cost of ownership by one-third.

Between 2006 to 2012, Huawei and Vodafone teamed up on six joint innovation centers. Although the solutions Huawei and Vodafone develop have been geared toward solving particular problems, they have greatly expanded Huawei’s global solution capabilities. In 2011, the two companies saw an opportunity to link the joint innovation centers together, thereby enhancing Huawei’s capability to provide more efficient global solutions to Vodafone and new customers.

By 2016, Huawei was partnering with a list of leading European telecom operators that included Vodafone, Deutsche Telekom, BT, Orange, and Telefónica in 18 joint innovation centers; in all, it had 34 innovation centers around the world. “The joint innovation centers really changed perceptions of Huawei from being a follower to being a leader,” a senior executive at Ericsson said. Huawei’s approach was so successful that competitors such as Ericsson established joint innovation partnerships of their own to develop practical and long-term innovations.

Stage 3: Enlist the support of governments, universities, and other industry stakeholders.

The success of Huawei’s approach to innovation has also depended on being accepted by governments and larger industry players. Although it’s common for multinationals to try to gain the favor of governments in the countries they seek to do business in by offering to build local manufacturing facilities, hiring well-connected local representatives, or launching PR campaigns, Huawei has gone to considerable lengths to present itself as the kind of partner European governments could work with.

During the global financial crisis and the subsequent recession, for example, the company maintained high levels of investment in R&D in Europe and became a champion for major innovation projects. To consolidate its market position in Europe, it set up a special public affairs and communications office in Brussels whose job is to frame the company’s investments in terms of how they advance the efforts of European governments and industry players to meet the global innovation challenges of the 21st century. In 2013, Huawei pledged to create 5,500 new jobs in Europe by 2019, which would increase its number of employees in the European Union by more than 50%.

One of Huawei’s new initiatives is a R&D center in Belgium that will spearhead and coordinate research around standards for 5G telecommunications from 18 R&D sites in Europe. Another is a collaborative effort located in Munich, Germany, called Openlab, which aims to work with partner companies such as Intel and SAP to drive innovation in areas such as the internet of things, cloud computing, and big data.

Huawei’s expansion in Europe follows a pattern that closely resembles the one the company used to build its position in China: Start at the perimeter and work toward the center. In Europe, Huawei initially targeted business opportunities in the United Kingdom and Hungary. Both governments seemed open to hedging their bets away from European Union companies and toward China and China-based companies. A big break came at the end of 2005, when Huawei was awarded a contract to provide transmission equipment to BT to upgrade its network. In selecting Huawei as a European supplier, BT gave Huawei an important boost in the European Union.

Huawei has also benefited from its ties to Hungary. In 2009, the company chose to locate its European distribution center in Hungary, and in 2011 it invested in a logistics center there, serving Europe, North Africa, Russia, and the Middle East. In the wake of these investments, Hungary has been instrumental in promoting broader acceptance of Huawei by other EU governments.

Huawei’s relationship with France has been more challenging. A 2012 report on cyberdefense by the French Senate recommended prohibiting the use of Chinese routers in either French or European telecommunications infrastructure.

In response to France’s security concerns, Huawei in 2012 vowed to become more transparent; among other things, it promised to divulge its source codes to the French and European governments. In 2014, the company also took an unusual position with regard to French taxes. At a time when global companies such as Google Inc. were being criticized for not paying their fair share of taxes to the French government, Huawei France decided to forgo some of the tax benefits it might have claimed (from R&D credits and losses). Huawei also made a commitment to invest $1.9 billion in R&D facilities in France by 2018, which was expected to generate about 2,000 new technical jobs through direct hires and sourcing from the French tech ecosystem made up of local suppliers, universities, research centers, and startups.

Reproduced from MIT Sloan Management Review

No comments:

Post a Comment